Answer:

Part A:

August 1:

Cash $6,500

Photography equipment $$33,500

Madison Harris Capital $40,000

August 2:

Prepaid Insurance $2,100

Cash $2,100

August 5:

Office Supplies $880

Cash $880

August 20:

Cash $3,331

Photography fees earned $3,331

August 31:

Utilities expense $675

Cash $675

Total $46,986 $46,986

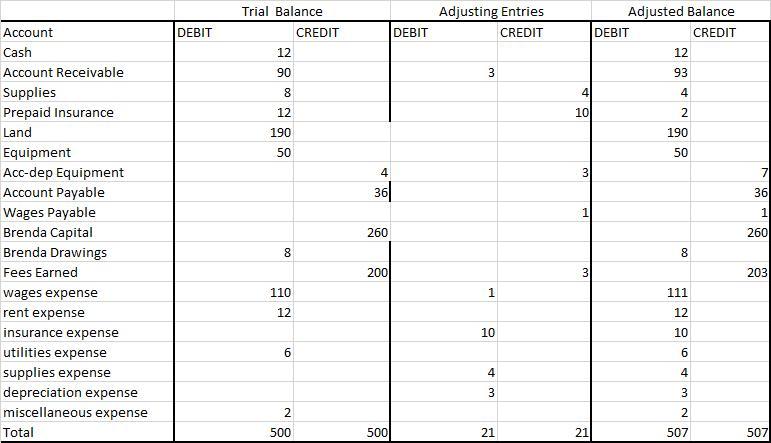

Part B:

Amount Debit($) Credit($)

Cash 6,176

Office Supplies 880

Prepaid Insurance 2,100

Photography Equipment 33,500

M.Harris Capital 40,000

Photography Fee earned 3,331

Utilities Expense 675

Total 43,331 43,331

Explanation:

Journal Entries:

It helps the company or firm to put all its transactions ion one sheet as debit and credit to keep track of its financial transactions. At the end total debit is equal to total credit.

Below are journal entries of above Transactions:

Amount Debit Credit

August 1:

Cash $6,500

Photography equipment $$33,500

Madison Harris Capital $40,000

August 2:

Prepaid Insurance $2,100

Cash $2,100

August 5:

Office Supplies $880

Cash $880

August 20:

Cash $3,331

Photography fees earned $3,331

August 31:

Utilities expense $675

Cash $675

Total $46,986 $46,986

Part B:

From Above Entries we can find the cash at the end:

Ending Cash=Total Debit Cash- Total Credit Cash

Ending Cash=(6,500+3,331)-(2,100+880+675)

Ending Cash=$6176

Preparing Trial Balance:

Amount Debit($) Credit($)

Cash 6,176

Office Supplies 880

Prepaid Insurance 2,100

Photography Equipment 33,500

M.Harris Capital 40,000

Photography Fee earned 3,331

Utilities Expense 675

Total 43,331 43,331