Answer:

in the explanation we can see the relationship between supply and demand.

Explanation:

The question is not clear, because some elements are missing. However, this is a situation where we want to describe the relationship between supply and demand for 3d TVs and how this varies if there is an increase in demand.

So let's analyze it in general terms.

Be D=Demand, E=equilibrium , P=Price, Q=Quantity.

Since Tabitha now earns more, she decides to buy a TV, then this increases demand (D2), which causes the equilibrium point (which in the graph corresponds to the intersection of the supply and demand curves) to change (E2). Thus, the higher the demand, the higher the price.

Answer:

The correct option is B

Explanation:

According to income tax laws, an individual will pay mess capital gains tax when his basis in an asset is higher. From the example, John has a personal residence and to increase his basis, he needs to think of what to add to the residence such that the selling price would increase and thus capital gain tax will reduce. From the option, the best and likely thing that would increase the basis of his asset (the house) and lead to an increase selling price is adding a new garage.

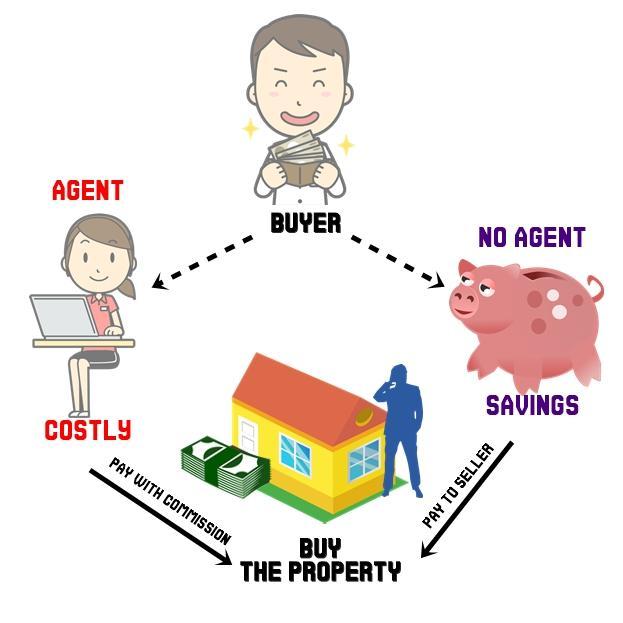

"The use of a buyer's agent guarantees that the buyer will get a property for the lowest price possible" is NOT an advantage of buyer's agency.

It is true that the efforts that a buyer's agent exerts on behalf of the buyer cannot be compromised and that the buyers can freely communicate confidential information without fear that disclosing that information will weaken their negotiating position. The buyers will also have the benefit of a licensee's expertise in finding the right property, negotiating the purchase and attending to closing details.

However, using a buyer's agent won't guarantee that the buyer can get the best deal on a property; as a result, this is not one of the advantages of buyer's agency. The agent would only consider what is best for the buyer and not the cheapest.

Agents will also charge extra fees and commissions for representing their buyers. To avoid additional expenses, some buyers and sellers choose not to use an agent. In order to save more money and find a property for the lowest price, buyers should avoid using an agent and instead deal directly with the seller.

Learn what happens when there's no buyer agency agreement in place here: brainly.com/question/28066390

#SPJ4

Answer:

C

Explanation:

Marguerite starts a corporation. Her articles of incorporation specifically state that the corporation will work in the beauty products industry. Marguerite would like to take out a loan on the company's behalf. She can because of the implied powers of the corporation.