Solution:

A Warranty is raised due to replace or corrects a product within the given period of time by the seller to the buyer. It is an obligation of the company. As per the matching principle the estimated warranty liability will reported as warranty expenses in the period when revenue is recognized

Journalizing is the process of recording of transactions in the book of original entry. It gives a complete picture of business transaction. It is recorded in chronological order. It is the pre phase for preparation of ledgers. Adjustment journal entry passed on the end of the year to get adjusted trial balance for preparation of financial statement.

The company H provides the additional information and required to calculate amount of warranty expenses and estimated warranty liability in different year ends and passing journal entry of the followings.

1.

Company sold copier of costing of $4,800 for $ 6,000 with an expected warranty cost of 4%.

Calculation of warranty expenses is as below.

Warranty expenses = rate of warranty * sales price

4% * $6000

= $240

Warranty expenses for the company which reported in the 2015 for the copier is $240

2.

Company sold copier of costing of $4,800 for $ 6,000 with an expected warranty cost of 4%.

Calculation of estimated warranty liability reported as of 31st December, 2015 is as below.

Estimated Warranty expenses = rate of warranty * sales price

4% * $6000

= $240

Estimated warranty liability for the company which reported as of 31st December, 2015 for the copier is $240

3.

In the year 2016 the company $209 repair required for the copier. And this amount charged against estimated warranty liability. The company provided two year parts warranty, for this warranty expenses charged in the year 2015.

Hence no further warranty expenses reported in the year 2016 for the copier.

4.

Computation of estimated warranty liability for the copier as of December 31st, 2016 is as below.

Balanced of Estimated Warranty liability =

Estimated Warranty liability in previous year - cost of repair charged against

estimated warranty liability balance

= $240 - $209

= $31

Balance of estimated warranty liability for this copier as of December 31st, 2016 is $31

5.

(a)

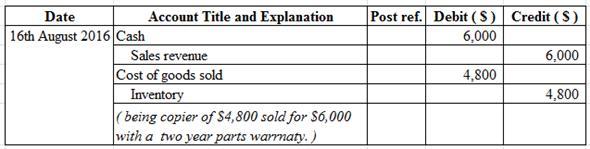

On August 16th, 2015 the company H sold a copier costing $4,800 for $6,000 and it required to pass journal entry as below.

[ Find FIGURE in attachment no. 1]

( consider year 2016 as 2015 and 2017 as 2016 in the attachment)

Cash account debited, because of increase of asset, sales account credited as the result increased the income. Cost of goods sold account debited, increase in expenses, and inventory account credited, because of decrease in value of asset.

Here the compound journal entry is passed, as company followed perpetual inventory system.

(b)

On December 31st 2015 the company required to pass the following adjustment entry to recognize the warranty expenses

[ Find FIGURE in attachment no. 2]

( consider year 2016 as 2015 and 2017 as 2016 in the attachment)

Warranty expenses account debited, because of increase of expenses and estimated warranty liability credited, because of increase in liability.

(c)

On November 22nd 2016 the company repairs on warranty sale and $209 of material taken form the repairs parts Inventory and the journal entry is passed as below.

[ Find FIGURE in attachment no. 3]

( consider year 2016 as 2015 and 2017 as 2016 in the attachment)

Estimated warranty liability debited, because of decrease in liability and Repair Parts Inventory account credited, because of decrease in asset.