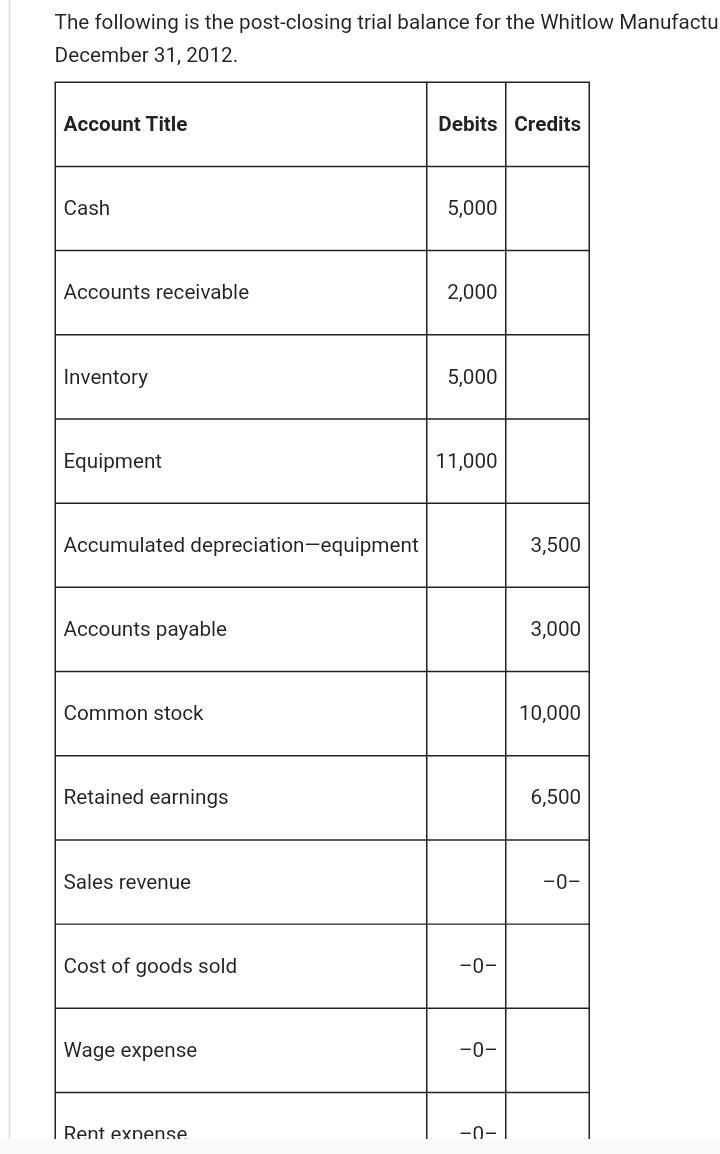

Debits Credits Cash 5,000 Accounts receivable 2,000 Inventory 5,000 Equipment 11,000 Accumulated depreciation 3,500 Accounts payable 3,000 Common stock 10,000 Retained earnings 6,500 Sales revenue 0 Cost of goods sold 0 Salaries expense 0 Rent expense 0 Advertising expense 0 Totals 23,000 23,000 The following transactions occurred during January 2021: Jan. 1 Sold merchandise for cash, $3,500. The cost of the merchandise was $2,000. The company uses the perpetual inventory system. 2 Purchased equipment on account for $5,500 from the Strong Company. 4 Received a $150 invoice from the local newspaper requesting payment for an advertisement that Whitlow placed in the paper on January 2. 8 Sold merchandise on account for $5,000. The cost of the merchandise was $2,800. 10 Purchased merchandise on account for $9,500. 13 Purchased equipment for cash, $800. 16 Paid the entire amount due to the Strong Company.18 Received $4,000 from customers on account. 20 Paid $800 to the owner of the building for January's rent. 30 Paid employees $3,000 for salaries for the month of January. 31 Paid a cash dividend of $1,000 to shareholders.