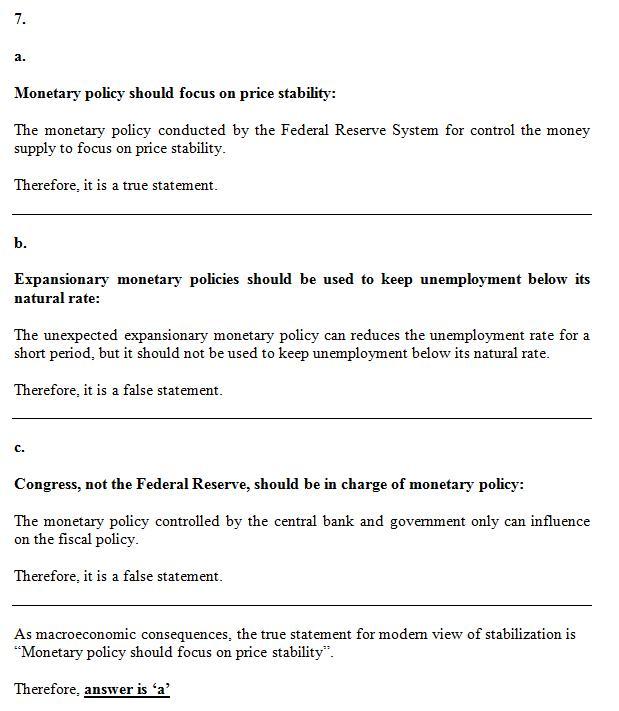

Answer:

<em>Executive Summary - 2. </em>

<em>Products and Service - 3. </em>

<em>Market Analysis - 8. </em>

<em>Competitive Analysis - 5. </em>

<em>Goals and Strategy - 1. </em>

<em>Funding Request - 4. </em>

<em>Marketing and Sales - 6. </em>

<em>Organization - 9. </em>

<em>Financial Analysis - 7. </em>

To successfully identify which information belongs to a specific business plan part, knowing the aim and order of each part is essential. You should realize how each part fits in the bigger picture.

Executive Summary - This is usually the beginning part of each business plan. Its deliverable is similar to the deliverable of the elevator <u>pitch</u>, or pitch in general. It should give key information on your company: <u>mission statement</u>, briefly highlight the financials and shortly describe the business operating. It should <u>briefly tackle the problem at hand</u> and just introduce the eventual solution.

Products and Service - It is always needed to explain your existing or planned product or service line, highlighting the benefits and key characteristics of your goods/services. A key component of this part is the <u>suppliers' part</u>, as it should be noted how many financial resources should be allocated to suppliers for materials and other prerequisites.

Essential information regarding products can vary. Some may require a special note on copyright laws, trademarks, or relevant policies in general.

Market Analysis - This is the part describing your comparison of several markets, the choice describing why you opted for that one, and the consumer characteristics in that particular market.

Here you need to utilize the needed statistics, carefully describing the <u>size and potential of a market</u>. Special attention needs to be given to <u>consumer habit</u>s, <u>purchasing power</u> and relevant info telling us why that particular customer segment would opt for our goods/services.

Competitive Analysis - Since every industry or area of business operating has <u>direct and indirect competitors</u> (unless we're making a business plan for a monopoly, which is unlikely), it is essential to tackle their strengths and weaknesses.

Here you need to put info regarding your competitor's business operating, how it gains its competitive advantage (if applicable) and which particular characteristic makes the competitor's customers opt for that business in the first place (unique selling proposition).

Goals and Strategy - This part refers to the concrete <u>recommendations</u> you, as a business consultant, have for the company, given the identified problems and issues.

This should be a real, defined <u>action plan</u> that makes <em>you differ from your competitors</em>, giving you the opportunity to get a competitive advantage. The strategies and tactics included can differ industry-wise and are often related to a specific area of business operating where the company faces critical problems.

Funding Request - Mainly placed on the end or separated from the core of the business plan, the funding request is key when <u>creating startups</u>. This part should put out how many financial resources to put your business on track and how you plan to use them. A funding request should be <u>created to approach investors and banks.</u>

Sometimes, a funding request is used in a broader sense than the business plan, as in that case, the request needs to have a part of the business plan attached, next to the key info (funds needed to start the company).

Marketing and Sales - Once you have conducted the analyses and made the recommendations, an adequate sales and marketing plan should follow. This is extremely important if a key constituent of your strategy is the placement of a new product.

This part should include <u>all things related to the marketing mix</u>: advertising plan, distribution channels, promotion and PR activities... Also, a marketing budget should be carefully allocated and elaborated.

When it comes to sales, you should include the <u>sales strategy</u> and sales target/projection.

Organization - Usually placed at the beginning of the business plan, the organization part should describe the <u>structure</u> and the <u>level of departmentalization</u> in the company. It often includes a diagram visually representing the divisions in your company. Also, it should be described which obligations and duties fall under each department.

Financial Analysis - Often placed at the end of a business plan, this part is critical to the overall effect and integration of the business plan. It includes the<u> financial history</u> and<u> financial success</u> of your company (reports on revenue, EBIT, profit, loss, ROI...), as well as the <em>projections</em> that relate to what will happen after you implement the strategies elaborated in the Goals and Strategy part.