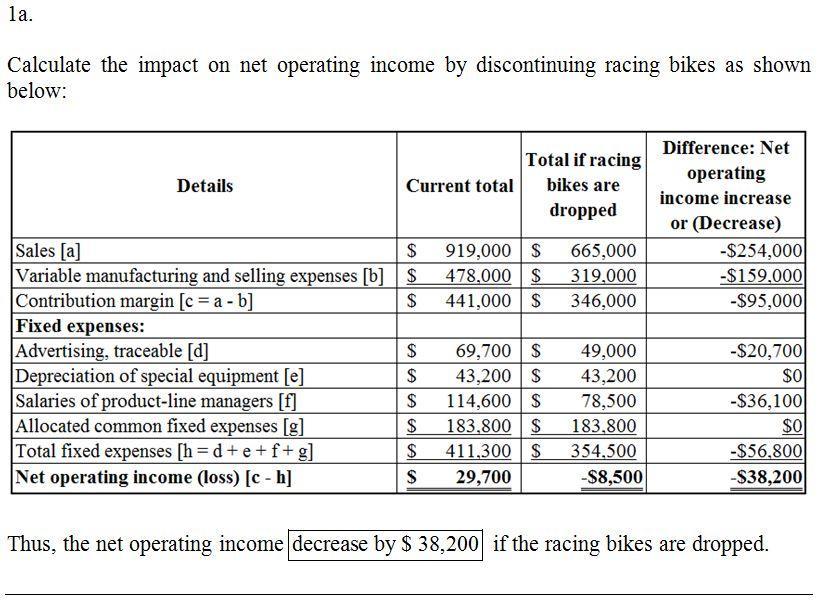

d expenses for the past quarter follow: Total Dirt Bikes Mountain Bikes Racing Bikes Sales $ 919,000 $ 265,000 $ 400,000 $ 254,000 Variable manufacturing and selling expenses 478,000 116,000 203,000 159,000 Contribution margin 441,000 149,000 197,000 95,000 Fixed expenses: Advertising, traceable 69,700 8,400 40,600 20,700 Depreciation of special equipment 43,200 20,100 7,400 15,700 Salaries of product-line managers 114,600 40,400 38,100 36,100 Allocated common fixed expenses* 183,800 53,000 80,000 50,800 Total fixed expenses 411,300 121,900 166,100 123,300 Net operating income (loss) $ 29,700 $ 27,100 $ 30,900 $ (28,300)*Allocated on the basis of sales dollars.Management is concerned about the continued losses shown by the racing bikes and wants a recommendation as to whether or not the line should be discontinued. The special equipment used to produce racing bikes has no resale value and does not wear out.Required:1a. What is the impact on net operating income by discontinuing racing bikes? (Decreases should be indicated by a minus sign.)Current total total if racing bikes are dropped Difference: Net operating income increase or (Decrease)? ? ? ?? ? ? ?Contribution margin: (loss) ? ? ?Fixed expense: - - -? ? ? ?? ? ? ?? ? ? ?? ? ? ?Total fixed expenses ? ? ?Net operating income (loss) ? ? ?** On the first column insert from the list stated in the bottom with the missing ?**(sales, variable expenses, advertising traceable , depreciation on special equipment, salaries of product managers, common allocated costs) 2a. Prepare a segmented income statement. Totals Dirt Bike Mountain Bikes Racing Bikes? ? ? ? ?? ? ? ? ?Contribution margin (loss) ? ? ? ?Traceable fixed expenses: - - - -? ? ? ? ?? ? ? ? ?? ? ? ? ?Total traceable fixed expenses ? ? ? ?? ? ? ? ?? ? - - -Net operating income (loss) ? - - -** On the first column insert from the list stated in the bottom with the missing ?**(Sales, Variable manufacturing and selling expenses, Advertising, depreciation of special equipment, salaries of the product line managers, product line segment margin, common fixed expenses)