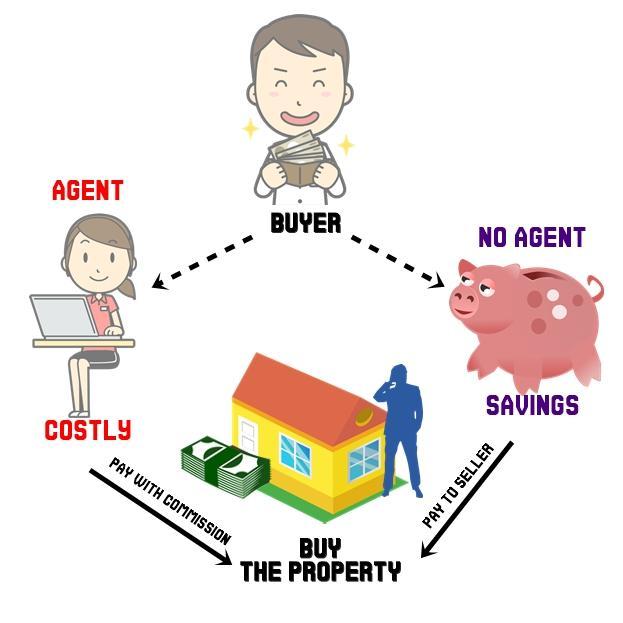

"The use of a buyer's agent guarantees that the buyer will get a property for the lowest price possible" is NOT an advantage of buyer's agency.

It is true that the efforts that a buyer's agent exerts on behalf of the buyer cannot be compromised and that the buyers can freely communicate confidential information without fear that disclosing that information will weaken their negotiating position. The buyers will also have the benefit of a licensee's expertise in finding the right property, negotiating the purchase and attending to closing details.

However, using a buyer's agent won't guarantee that the buyer can get the best deal on a property; as a result, this is not one of the advantages of buyer's agency. The agent would only consider what is best for the buyer and not the cheapest.

Agents will also charge extra fees and commissions for representing their buyers. To avoid additional expenses, some buyers and sellers choose not to use an agent. In order to save more money and find a property for the lowest price, buyers should avoid using an agent and instead deal directly with the seller.

Learn what happens when there's no buyer agency agreement in place here: brainly.com/question/28066390

#SPJ4

Answer:

D.

Explanation:

Aggregate Planned Expenditure (AE) can be defined as the sum value of all the finished products and services in an economy. This value is calculated by adding all the expenditures that are considered in an economy. These components are household consumption (C), planned investments (I), Government expenditures or purchases (G), and net exports (NX) [net exports is the difference between the total exports and total imports].

<u>The sum value or the aggregate planned expenditure is calculated by adding all these components</u>.

So, the correct answer is option D.

Complete Question:

When preparing the financial analysis for a business plan, the required statements and schedules will depend on the:

Group of answer choices

A. size of the particular project.

B. plan's presentation procedure that is expected in your own organization.

C. project's complexity.

D. All of these are correct.

Answer:

D. All of these are correct.

Explanation:

Financial analysis can be defined as the process of analyzing the stability, profitability, accuracy and viability of a business entity through its financial statements.

Financial statements can be defined as a document used for the formal communication or disclosure of financial information and statements to present and potential users such as investors and creditors. These includes balance sheet, statement of retained earnings and income statement.

Hence, when preparing the financial analysis for a business plan, the required statements and schedules will depend on the following;

A. size of the particular project.

B. plan's presentation procedure that is expected in your own organization.

C. project's complexity.

Answer:

E) Trading company

Explanation:

In international trade, trading companies are basically wholesalers that work at an international level. They usually purchase products from different businesses and then resell them to local retail businesses or sometimes final consumers (less common). Trading companies generally enter a exclusive distribution agreement with the manufacturer per region or country that they operate in.

Answer:

An employer hiring someone to handle financial information.

An apartment owner determine whether to rent a unit to someone.

A car insurance company predicting the likelihood of future claims.

Explanation:

Mark me brainliest